For many years, the United States has been a land of promise for global investors, where vision and resources unite to establish financial prosperity. The EB-5 Immigrant Investor Program provides a straightforward path to realizing these goals, offering a copyright through investment for those who can provide a meaningful economic impact to the U.S. economy. This is not simply a financial decision but a process-one that calls for thorough preparation, substantial financial commitment, and comprehensive knowledge of a complex legal framework. This guide functions as your comprehensive resource, a detailed map for understanding the complexities of the EB-5 program. Let's delve into the critical financial thresholds, the crucial aspects of investment location, the rigorous application process, and the final benefits of this unique immigration journey. Whether you are initially investigating your options or are ready to take the next step, this article will offer the clarity and insight you need to advance decisively toward your American dream.

Core Takeaways

- The EB-5 investment program delivers a clear route to getting a U.S. copyright for investors, their wives or husbands, and single children below 21 years of age through a significant investment in the United States economy.

- The regular EB-5 investment amount comes to $1,050,000, but this lowers to $800,000 for investments in a TEA (Targeted Employment Area) or qualifying infrastructure projects.

- The Targeted Employment Area TEA represents a geographic region that's rural or experiencing high unemployment, and investing there offers a pathway to qualify with reduced capital requirements.

- Fulfilling the fundamental EB-5 visa requirements is non-negotiable; this requires verifying the legitimate source of capital, placing the capital "at risk," and generating no fewer than 10 U.S.-based full-time positions.

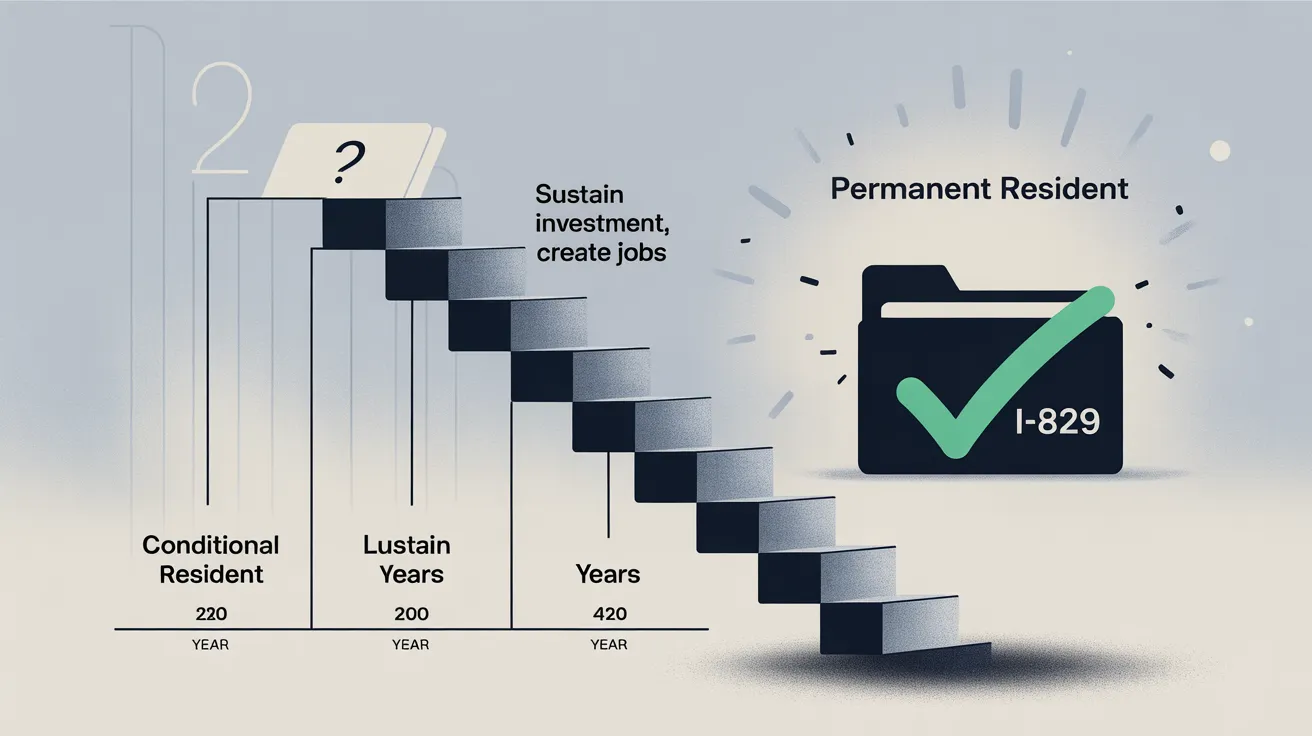

- The final stage arrives in acquiring a permanent copyright through investment after a two-year conditional residency period, which calls for submitting a final application (Form I-829) to verify compliance.

- Engaging an experienced EB-5 lawyer is fundamentally important for dealing with the intricate process, throughout the entire application journey.

Decoding the Financials: A Deep Dive into the EB-5 Investment Amount

The financial commitment stands as the key element of the EB-5 program, and a complete knowledge of the required EB-5 investment amount is the crucial initial phase for any prospective investor. The program is organized to promote financial commitment in designated locations of the U.S. economy, and consequently, the required investment amount varies depending on the regional setting of the investment project. This is not just a transactional fee but a substantial capital injection into a new commercial enterprise that is expected to generate economic activity and employment. The investment has to be fully "at risk," meaning it is subject to both potential gains and losses, without any guarantees of return. This essential component underscores the entrepreneurial nature of the program and differentiates it from a simple visa purchase. USCIS adjudicators will meticulously review the project's business plan and financial structure to ensure the capital is genuinely at risk of loss and not a passive, guaranteed loan.

Breaking Down the $800,000 vs. $1,050,000 Choice

USCIS has established a two-tiered investment framework to channel capital to areas most in need of economic growth. The reduced investment amount of $800,000 is designated for projects located in a Targeted Employment Area (TEA). For all projects not within these specified areas, the investment threshold rises to $1,050,000. This significant $250,000 variation in capital commitment makes the location of your investment a crucial strategic choice that can substantially impact your EB-5 process. It is moreover crucial for investors to account for additional costs beyond the principal investment. These comprise USCIS filing fees, legal fees for your immigration lawyer, and administrative fees assessed by Regional Centers. These ancillary costs can be substantial and must be included in your financial strategy from the start to maintain a smooth and reliable process avoiding unexpected financial challenges.

Strategic Geography: Understanding the Significance of a Targeted Employment Area (TEA)

The concept of a Targeted Employment Area TEA plays a crucial role in the EB-5 program's economic development goals and represents a powerful strategic advantage for strategic investors. A TEA is defined by USCIS as either being a designated rural area or a location with an unemployment rate of at least 150% of the national average. By establishing a lower investment threshold for projects in these areas, the program seeks to stimulate economic growth and establish job opportunities where they are needed most. For the investor, a TEA-based project delivers not only a significantly lower capital requirement but also additional benefits. Under the EB-5 Reform and Integrity Act of 2022, visa set-asides were created for TEA projects, which can lead to faster processing times for investors from backlogged countries. The determination of a TEA is a statistics-based procedure based on official statistics, and investors must work with their legal team to verify their chosen project meets requirements at the time of filing their petition, as these designations may vary over time.

Your Blueprint for Success: Meeting the Core EB-5 Visa Requirements

In addition to the financial investment, the EB-5 program features fundamental requirements that each applicant must fulfill to qualify for a copyright. These EB-5 visa requirements are designed to ensure that the investment has a authentic, substantial, and positive impact on the U.S. economy. First, the investment must establish at least 10 full-time, permanent jobs for eligible U.S. workers. The approach for tracking these jobs distinguishes between direct investments (which only count direct W-2 employees) and Regional Center projects (which can also count indirect and induced jobs). Additionally, as noted earlier, the investment funds must be totally committed and "at risk" in a new commercial enterprise, subject to both gain and loss. Ultimately, the investor must provide meticulous, credible documentation to establish that the investment capital was sourced through lawful means. This "source of funds" requirement is among the most challenging aspects of the entire process, necessitating a clear paper trail for every dollar invested.

Understanding the Two Paths towards Residency: Direct Investment vs. Regional Centers

The EB-5 program provides two separate investment options: the Regional Center program and the direct investment pathway. A Regional Center is a USCIS-approved institution that administers investment projects and combines capital from multiple EB-5 investors. This is a more indirect investment choice, as the Regional Center handles the day-to-day management of the project and the complex task of tracking job creation. This structure is frequently selected by investors who prefer not to be responsible for running a U.S. business. In contrast, a direct investment is a more involved approach where the investor takes an active role in the administration of the business they invest in. This choice offers greater oversight and direct oversight but also necessitates considerably more operational involvement and a thorough understanding of the U.S. business environment. The selection between these two paths depends entirely on the investor's risk appetite, desire for control, and overall investment approach.

The Path to Prosperity: Navigating Your I-526E Petition

The formal EB-5 process begins with the submission of Form I-526E, Petition for Alien Entrepreneur. This documentation acts as the official investor submission to USCIS and should be submitted with a comprehensive set of documents that verify compliance with all EB-5 requirements. This represents more than a basic form; it is an extensive legal and financial documentation that serves as the blueprint for the complete immigration journey. It contains a detailed project business plan, proof of investment transaction, and comprehensive proof of funds documentation. The quality, accuracy, and thoroughness of this petition are crucial for a successful outcome, as any inconsistencies or gaps may result in lengthy delays or even denial.

The Essential Function of Source of Funds Documentation

The source of funds documentation is arguably the most demanding and reviewed component of the I-526E petition. Investors need to establish a clear, logical, and unbroken documentation path that traces the investment capital from its origin to the EB-5 project. This includes providing extensive tax filing history, bank statements, proof of earnings from employment or company ownership, proof of property or asset transactions, and legal documents for any gifts or loans used. The completeness and clarity of these records are essential to the petition's approval. USCIS scrutinizes this documentation meticulously to stop fraud, money laundering, and to ensure the overall Targeted Employment Area TEA integrity of the program.

Understanding the Timeline: Visa Bulletins and Priority Dates Explained

Because of annual per-country visa limits, investors from countries with high demand for EB-5 visas, such as China and India, might experience a considerable waiting period termed a visa backlog. The Visa Bulletin, released monthly by the U.S. Department of State, delivers details about visa availability. When a candidate submits their I-526E petition, they are allocated a Priority Date. They must then wait for their priority date turns "current" on the Visa Bulletin before they can proceed with the final steps of securing their copyright. This waiting period can be a source of considerable anxiety for families and investors, but with appropriate preparation and strategic guidance from an immigration attorney, it can be navigated successfully. Being aware of the visa set-asides for TEA projects can also be a key strategy in potentially decreasing this wait.

Transitioning to Permanent Residency: Investment-Based copyright Process

Upon acceptance of the I-526E petition and when a visa is available, the investor and their qualifying family members are granted a two-year Conditional copyright. This allows them to live, work, and study in the U.S. as lawful residents. However, the "conditional" status indicates the process is not yet finished. To receive a permanent copyright through investment, the investor must submit Form I-829 within the 90-day timeframe before the conditional copyright expires. This petition acts as the final proof, showing that the investment was continued throughout the two-year period and that the required 10 jobs were established and sustained. Upon the approval of the I-829, the conditions are lifted, and the investor and their family achieve status as lawful permanent residents of the United States, the ultimate and most fulfilling step in the EB-5 process.

The Critical Role of an Experienced EB-5 Attorney: Your Legal Guide

The EB-5 program is a complex and constantly evolving component of United States immigration policy, with nuances that can be challenging for even the most sophisticated investor. Navigating the detailed requirements, from initial project due diligence to the final visa conditions removal, necessitates a thorough and up-to-date understanding of the legal landscape. An experienced EB-5 lawyer functions as your legal advisor, offering essential support at every stage of the process. They will help you conduct due diligence on prospective investments and Regional Centers, thoroughly document and verify your funding sources, develop the detailed legal documentation that backs your petition, and speak on your behalf before USCIS. The right legal counsel can be the deciding factor between a favorable conclusion and a problematic, prolonged denial. An EB-5 lawyer is more than just a legal consultant but a vital strategic ally in your immigration journey.

The Long-Term Value: Understanding EB-5 Program Benefits

Even though the EB-5 program requires a considerable financial commitment and multiple years of involvement, the benefits of this investment are beyond measure. This represents a gateway to a fresh start, abundant in opportunity and independence. The advantages extend far beyond any possible financial benefits. A U.S. copyright grants the ability to study, work, and reside throughout America, creating a world of possibilities for the investor and their family. Children gain access to premier academic institutions at domestic student rates. After five years as permanent residents, the investor and dependents may be eligible to pursue U.S. citizenship, completing their journey to becoming fully integrated members of American society. This is the most valuable outcome-a legacy of opportunity, security, and freedom for years to come.

Common Questions

What are the acceptable sources of funds for an EB-5 investment

USCIS mandates a comprehensive and detailed documentation for the origin of all investment funds to verify they were legally acquired. Permissible sources comprise salary savings, income from investments (such as securities or property), dividends from business ownership, revenue from real estate transactions, proceeds from business sales, and monetary gifts from others. When funds are received as a gift, comprehensive proof of the donor's legitimate fund source must be provided. The investment can be funded through loans, though the loan must be secured by the investor's assets, and the investor needs to be personally responsible for the loan.

What is the expected timeline for EB-5 processing?

The length of the EB-5 journey differs substantially due to various elements, like the investor's home country, the particular circumstances of their application, and processing durations at USCIS. The initial I-526E petition usually needs between several months and two-plus years for USCIS to adjudicate. After approval, applicants from visa-backlogged nations (such as China and India) may have to wait multiple years for their priority date to become current on the Visa Bulletin. The full procedure, from initial investment to receiving a permanent copyright, typically requires three to ten years or potentially longer.

What should I expect if my I-829 petition is denied?

If an I-829 petition to remove conditions receives a denial, the applicant's conditional copyright status will be terminated, and they could face in removal proceedings. However, this is not definitively the end of the road. Options exist to contest the decision through the Administrative Appeals Office (AAO) or to lodge a motion to reconsider or reopen the case with USCIS. In certain situations, it could be possible to submit new documentation or legal positions. It is essential to consult an experienced EB-5 lawyer promptly upon receiving a notice of intent to deny or a denial to navigate this complicated process and investigate all possible legal solutions.

Is travel outside the U.S. permitted with a Conditional copyright?

That's correct, as a conditional copyright, you are permitted to travel outside the U.S. with your conditional copyright, which functions as a valid re-entry document. However, it is crucial to preserve your residency in the U.S. and not to make any trips that could be viewed by immigration authorities as an abandonment of your U.S. residency. Long periods away from the U.S., typically for more than six months to a year, could generate a presumption that you have given up your residence and could put at risk your right to re-enter the country and to lift the conditions on your copyright.

How do direct and indirect job creation differ

Employment generation is the core foundation of the EB-5 program. Direct jobs consist of roles established within the new commercial enterprise in which the investor has invested. These are identifiable, W-2 employees of the company who work for the enterprise. Indirect jobs are those generated as a secondary effect because of the investment but not through the new commercial enterprise, like jobs created for suppliers of goods to the project. Induced employment refers to positions generated when the EB-5 project employees using their income in the community. Regional Center investments can count direct, indirect, and induced jobs (calculated using approved economic models), which simplifies the process to meet the 10-job requirement. Direct investments must rely solely on direct jobs.